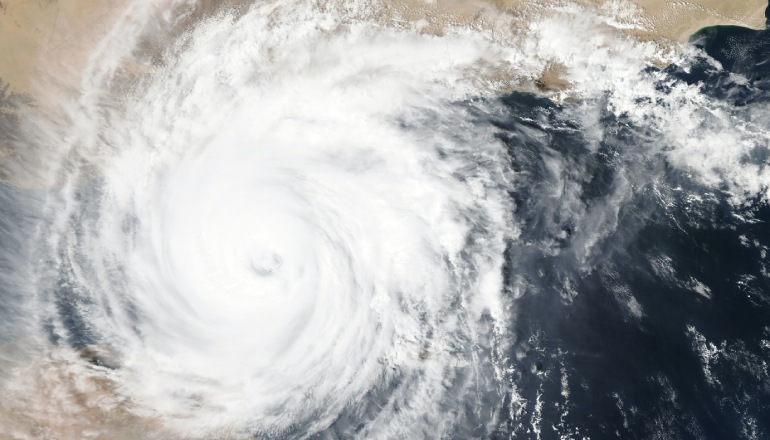

UST, a digital transformation solutions company, and mistEO, a climate fintech company, have announced a strategic partnership to benefit the banking, financial services, and insurance (BFSI) customers in the US with accurate weather analytics.

The partnership enables UST to leverage mistEO’s weather analytics capability to accurately predict localized climate events. This will help them to provide BFSI clients with accurate risk assessment models associated with climate change.

These cutting-edge models enable BFSI clients to make informed decisions and offer tailored insurance products specifically in the property & casualty (P&C) and travel insurance segments.

A lack of precise, localized weather data has resulted in substantial underwriting uncertainty and inflated insurance premiums, UST said in a press release. The partnership will help the BI customers to provide climate risks insights, and incorporate climate resiliency into their business strategy.

“This partnership marks an exciting juncture in the weather insurance and climate financing space worldwide. … Our joint efforts will redefine risk management and lay the groundwork for a more resilient and sustainable future,” said Samuel John, Chief Executive Officer, mistEO.

“With our combined expertise, we will harness the power of disruptive technologies to deliver unparalleled value to our BFSI clients. This partnership allows us to provide climate decision intelligence to enhance investment management decisions, lending, and insurance underwriting, and provide critical data points to access ESG strategy and risks…,” said Maureen Doyle-Spare, General Manager, Financial Services, UST.