Electric vehicles or EVs adoption have been widely promoted as part of net-zero targets. However, there are still concerns that are keeping consumers away from shifting to e-vehicles. According to a survey by S&P Global Mobility, the two most prominent reasons are affordability and infrastructure concerns.

Battery EVs are getting closer to price parity with their internal combustion siblings.

The price range concerns are not just a US-market phenomenon. It’s affecting consumers worldwide, even in regions where EVs have made significant market inroads.

Highlights

- Almost half (48%) of the 7,500 respondents globally consider EV prices to be too high.

- Consumer sentiment toward buying an EV has cooled considerably over the last two years.

- Despite an increased number of EVs available and improved consumer awareness of tax credits and benefits, fewer than half of respondents believe the EV technology is ready for mass market adoption.

- Only 42% of respondents are considering an EV for their next vehicle purchase, and 62% of respondents are waiting until the technology improves before purchasing a new vehicle.

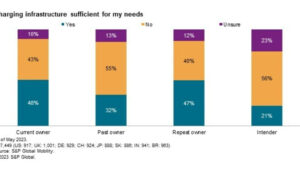

- Charging concerns are second only to vehicle costs.

- About 46% of respondents are concerned about the time required for charging.

- 44% are concerned about the availability of charging stations.

“Pricing is still very much the biggest barrier to electric vehicles,” said Yanina Mills, Senior Technical Research Analyst, S&P Global Mobility.

How things have changed

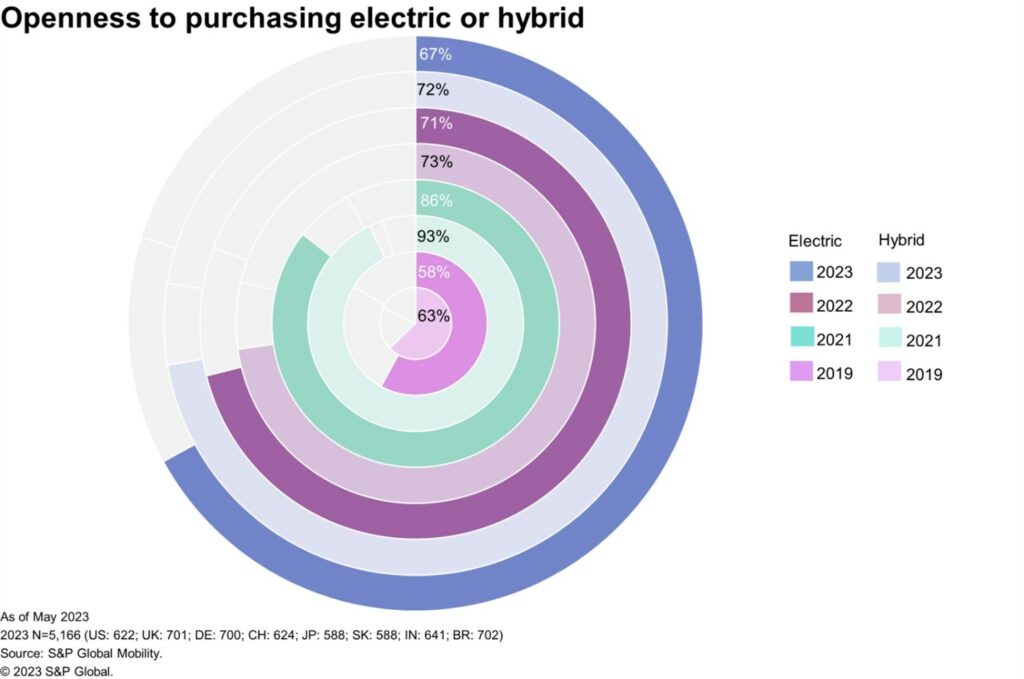

Initially, consumer interest was smothered by the limited variety of available EV models. Just 58% of 2019 S&P Global Mobility survey respondents were open to purchasing an EV, as luxury-priced models dominated the early EV market. Just a handful of mainstream models, like the Chevrolet Bolt, Nissan Leaf, and Tesla Model 3, were available at that time.

But 2021 saw a dramatic burst of consumer EV acceptance. Buyer willingness soared, with 86% of global respondents being open to acquiring an EV. Multiple factors stirred up these good feelings: New mainstream models from Ford, Hyundai, Kia, and Volkswagen hit the market. The pro-EV push in the US by the Biden administration and legislation in multiple US states and Europe banning future internal combustion engine (ICE) vehicles further heightened visibility.

While 67% of the 8,000 participants surveyed in May 2023 were open to the idea of purchasing an EV—certainly higher than in 2019—it is a whopping 19 percentage point decline from 2021.