India’s tender-driven renewable energy market faces challenges in procurement of power from grid-connected solar PV projects, with delays in signing PSAs exceeding 40 GW.

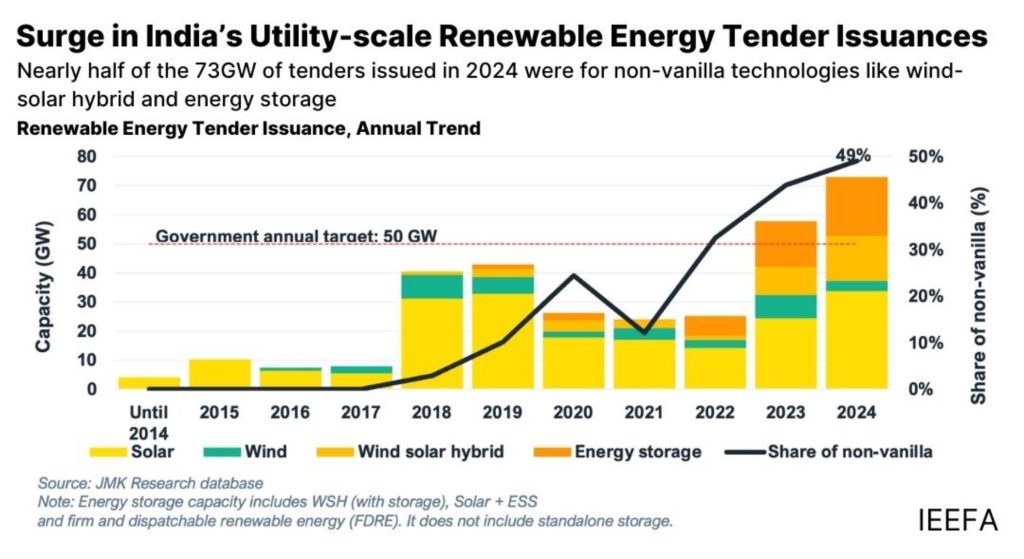

A new Institute for Energy Economics and Financial Analysis (IEEFA) report finds that despite record-high utility-scale renewable energy tender issuances in 2024, ongoing issues with project execution could deter investor interest.

Challenges:

The increase in renewable energy tendering and allotment after 2022 has led to a rise in challenges related to the realization of utility-scale projects in India.

These challenges include complex tender designs and insufficient power evacuation infrastructure. If not addressed properly, these issues can lead to three interconnected outcomes: undersubscription, delays in power agreement signing, and tender cancellation, the IEEFA report notes.

According to the report, financial prerequisites, such as high bank guarantees and financial closure deadlines, can discourage developer participation in tender auctions. Land prices and availability are also affected by stringent commercially useful function requirements in tenders. Power evacuation infrastructure and the ISTS transmission infrastructure are overstressed. Policy irregularities and aggressive bidding can also hinder project realization.

Undersubscription in renewable energy tenders is a significant issue, with approximately 8.5 GW of capacity in 2024 being undersubscribed, five times higher than in 2023, as per the report.

Aggressive bidding in time-constrained environments can lead to unrealistic tariff discoveries, and stringent financial prerequisites can discourage developer participation. Developers are becoming increasingly cautious about bidding on new projects, leading to further undersubscription.

For example, SECI is facing delays in signing power purchase and sale agreements with state electricity distribution companies (DISCOMs). The Ministry of Power’s guidelines suggest the process should take 140 days, with SECI obligated to facilitate signing within 40 days. As of January 2025, 11.8 GW of capacity from 12 renewable energy tenders remains on hold, with solar and manufacturing-linked tenders accounting for over 30% of the total unsigned capacity.

Industry stakeholders argue that the delay in signing PPAs is due to falling renewable energy tariffs, higher tender price discovery, and additional time for state DISCOMs to obtain approvals. Power developers say that the strict bidding trajectory pressures REIAs to issue bids without securing offtake agreements. The June 2025 expiration of ISTS waivers is also causing concern as state utilities seek an extension before committing to long-term PSAs.

Tender cancellations:

From 2020 to 2024, 38.3 GW of utility-scale renewable energy capacity was cancelled, accounting for 19% of the cumulative RfS issued capacity.

According to the report, the peak in cancellations occurred in 2023, with ESS-based renewable energy tenders accounting for two-thirds of the cancelled capacity. Tender cancellations can occur before or after auctions, with 32% of capacity offered being cancelled after the auction due to undersubscription, delays in signing the PSA, and other issues. In 2021, SECI cancelled a 7.5 GW solar tender due to technical and financial challenges.

Standalone ESS projects:

Standalone ESS projects are energy storage systems without renewable components, supplied and maintained by developers, with charging and discharging handled by the tendering authority. These tenders are based on battery + ESS (BESS) or pumped hydro storage (PHS). However, challenges in India’s tender-driven renewable energy market, such as novel tender designs, auction delays, PPA signing delays, and site selection issues, have led to cancellations or shelved capacity. For example, RUMSL suspended the 16.4 GW PHS tender in Madhya Pradesh due to site identification and land acquisition issues, likely revised. Another standalone ESS tender was cancelled in 204.9 due to fake bank guarantees.

Impact on India’s commitment to set up 500 GW of renewable energy capacity by 2030:

As per IEEFA, India’s commitment to set up 500GW of renewable energy capacity by 2030 requires a significant effort from all stakeholders to address project realization challenges and maintain a sustained tendering momentum.

Delays in power agreement signings and cancellations have created a vicious cycle, deterring investor interest in future projects. The US authorities alleged bribery in SECI’s 12 GW solar-linked manufacturing tender, which could affect the availability of low-cost overseas financing from large-scale investors, IEEFA said in the report.

Developers are increasingly cautious when bidding for utility-scale renewable energy tenders, and delays in project implementation pose a major challenge for India’s long-term renewable energy target. The average annual tender cancellation rate will rise marginally in the short term, but with enhanced streamlining of the tendering process and transmission augmentations planned by the central government, the cancellation rate will stabilize in the closing years of the decade.

| India’s Renewable Energy Tendering Challenges data in a nutshell |

| • 8.5GW of utility-scale tenders undersubscribed in 2024, five times higher than 2023. |

| • Factors include complex tender designs, aggressive bidding, and infrastructure delays. |

| • Cumulative unsigned power sale agreement capacity exceeds 40 GW. |

| • Delays in signing PSAs due to falling tariffs, additional time for state distribution companies, and renewable energy implementing agency pressure. |

| • 38.3 GW of capacity was cancelled from 2020 to 2024. |

The new entrant narrative:

Essar Group, a multinational conglomerate, has entered India’s renewable energy tendering market, winning 900 MW capacity in 2024.

This follows other foreign IPPs like BrightNight and Zelestra, who have won a cumulative capacity of over 900 MW. Gentari, Petronas’ global renewables arm, won a capacity of 400MW in an SJVN 1200MW WSH tender. Hexa Climate, backed by I Squared Capital, forayed into utility-scale renewable energy. Some new entrants focus on standalone

BESS tenders.

Conclusion:

The market has matured, and stakeholders have developed a strong understanding of renewable energy technologies. The centralized tendering model may face decentralization to cater to each state’s unique requirements.

However, challenges such as delays in PSA signings, undersubscriptions, and cancellations have hindered the realization of these projects. Tendering authorities are now focusing on off-taker demands and developing innovative solutions like demand-following FDRE, the IEEFA report said.

The lack of resilient power evacuation infrastructure is a significant risk factor for India’s renewable energy market development. To ensure viable renewable energy tendering market growth, the central government must give equal impetus to all facets of the tendering process, specify annual targets for allotment and power agreement executions, and enforce renewable purchase obligations and associated penalties.